Use Patience to “Guarantee” Investment Returns

This year’s markets have been characterized by high levels of volatility. Couple this with last year’s lackluster returns and you may be asking, “How can I get a guaranteed positive return on my investments?”

Here’s How Not to Do It

Many people opt for the guaranteed return associated with annuities. Over $200 billion is invested each year in the US in these products. However, fees are often high and you’ll likely need to pay steep surrender charges if you want to get your money out early.

Variable annuities are among the worst offenders, clocking in at about 3% in annual fees including attached benefit riders. This is significantly higher than the 0.25% or less charged by many ETF’s.

Fixed indexed annuities should also be avoided. These typically have very high built in commissions for agents. As a result, from 2008-2013, these products averaged subpar returns of 3.27% and have 7-10 year surrender charge periods. In other words, if you want your money back before 7 years goes by, you’ll need to pay a steep penalty which will further erode that lousy 3.27% return.

Stocks Also Seem Like a Bad Choice

If you’re looking for a guaranteed return, stocks also seem like a bad choice. Historical data shows that stock market returns vary widely in any given year. The worst-ever one year return for stocks was a loss of 43.84% in 1931 while 1954 was the best year with a 52.56% gain.

Bonds are Safer, But Still Not Safe

Investors consider bonds to be a safer investment than stocks. And while they are less volatile, returns can still vary widely. The worst year for bonds was 2009 when they lost 11.12% and their best year was 1982 when they gained 32.81%

Simple Diversification Helps, But Still Not Enough

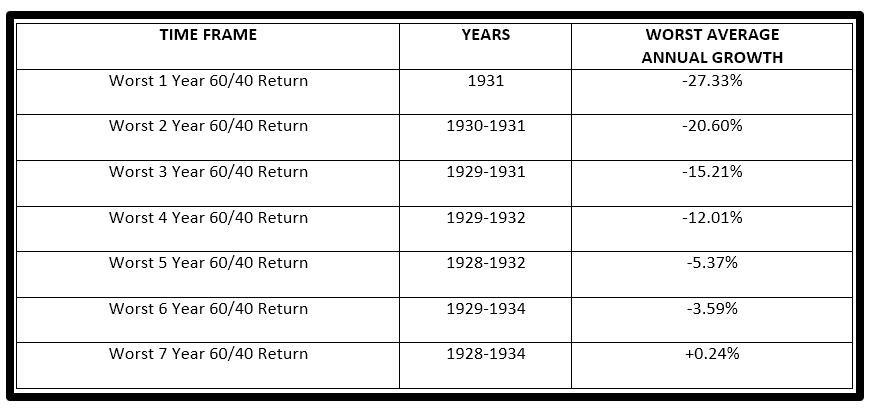

So, what happens when you construct a portfolio made up of 60% stocks and 40% bonds? Returns still vary widely, but not as much as a stocks-only portfolio. The worst single year for this 60/40 portfolio was a 27.33% loss in 1931 and the best ever year was a gain of 32.85% in 1954.

Here’s Where the Patience Comes In

One of the things that is true about financial markets is that they don’t stay bad forever and they don’t stay good forever. Big swings occur on a yearly basis, but the long term trend is definitely positive. As a result, if you’re willing to ride out the ups and downs, you have a better and better chance of avoiding a loss and capturing the long-term positive trend of the markets.

Going back to our historical data and our hypothetical 60/40 stocks/bonds portfolio you can see how this plays out:

By being willing to hold onto this simple portfolio for 7 years, historical investors have effectively guaranteed themselves a positive return. And we’ve been focusing on the worst-ever returns. The average return across all 7 year periods from 1928-2015 for this hypothetical portfolio is 8.92%, which is far better than the 3.27% recent performance turned in by variable annuities that require you to hold them for 7 years.

By being willing to hold onto this simple portfolio for 7 years, historical investors have effectively guaranteed themselves a positive return. And we’ve been focusing on the worst-ever returns. The average return across all 7 year periods from 1928-2015 for this hypothetical portfolio is 8.92%, which is far better than the 3.27% recent performance turned in by variable annuities that require you to hold them for 7 years.

Your Assignment

If you have some money to invest and know you’ll need it in 5 years or less, consider sticking to certificates of deposit that will give you a small, but guaranteed return.

However, if you’re reasonably sure you won’t need the money for more than 5 years, consider investing in a diversified portfolio of stocks and bonds. History is no guarantee that you’ll avoid a loss, but the numbers sure look compelling when you go back and look at the data.

This article was originally published on NerdWallet.com